In Germany, just as in many other countries, the current global political climate is continuing to cause uncertainty among businesses and consumers, casting a shadow over the advertising sector. This is evident in the trajectory of advertising revenues in commercial media.

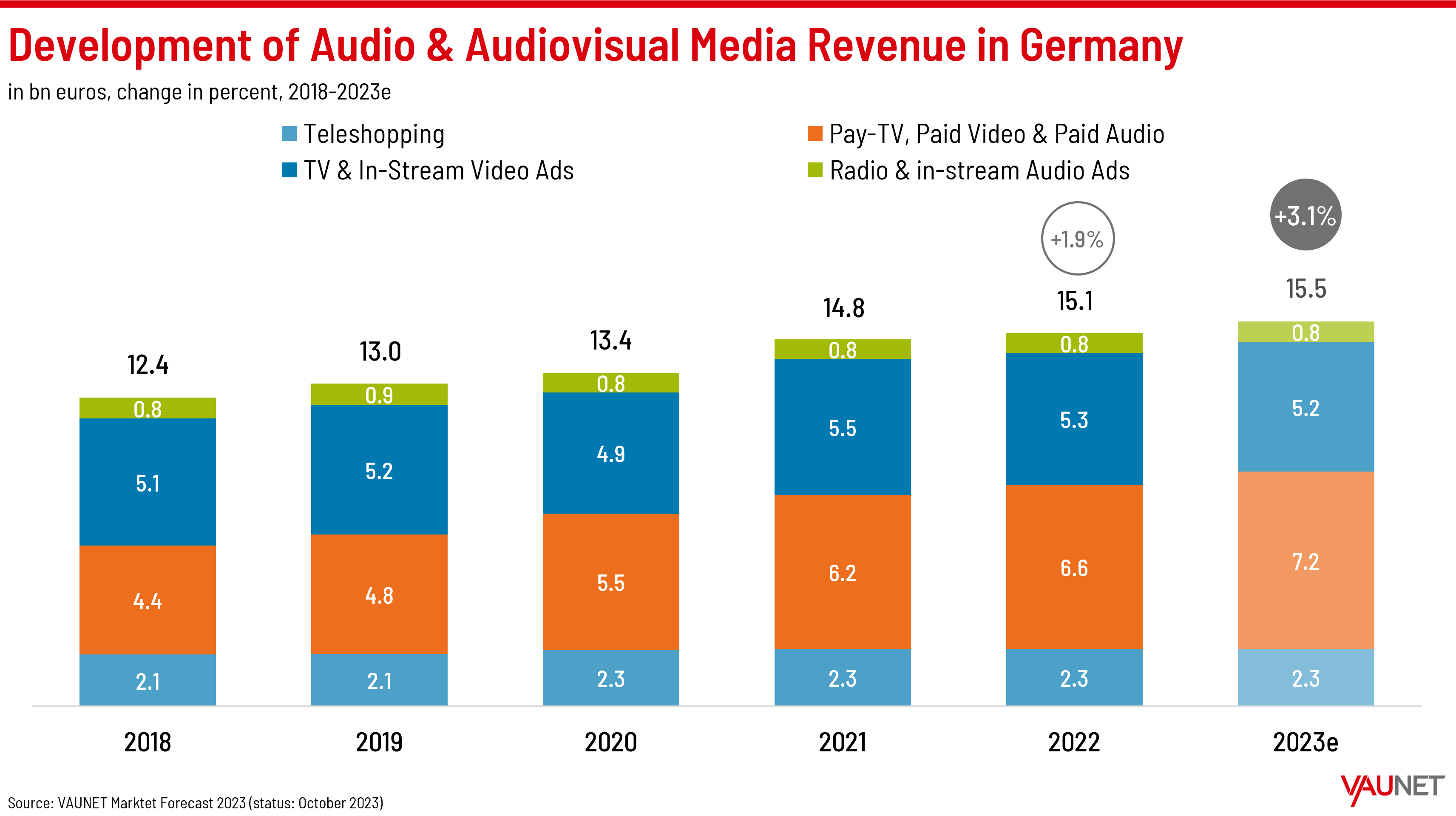

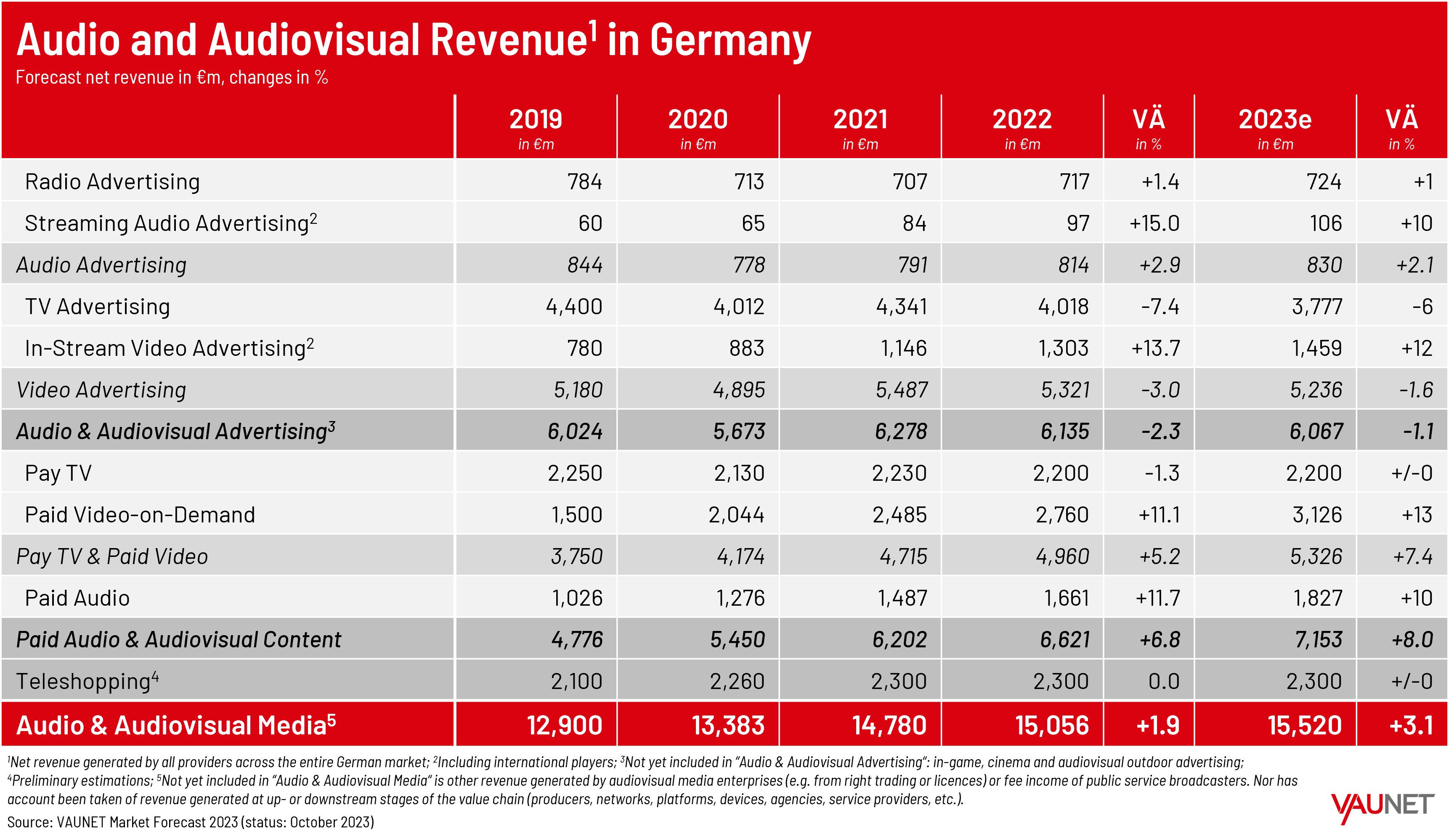

For 2023, total revenues of audio and audiovisual media in Germany are projected to rise by 3.1 %, totalling €15.5 billion (2022: €15.1 billion). This growth is largely driven by revenues from subscription services and advertising within the streaming domain. Concurrently, VAUNET anticipates a modest 1.1 % dip for the year in net advertising revenues across all audio and audiovisual media, i.e. radio and TV advertising as well as advertising on audio and video streaming. Television advertising is set to bear the brunt of this decline, with revenues expected to fall by 6 %. While radio advertising will see a mild uptick, and the streaming sector is poised for substantial double-digit growth, neither will match the numbers projected in spring. These are the key findings of the 2022 revenue statistics and the 2023 projections for the German audio and audiovisual media market presented today in Berlin by VAUNET (German Media Association), the umbrella organization for commercial media.

Frank Giersberg, Managing Director of VAUNET, commented: “Our data underscores the significant economic weight of the audio and audiovisual sectors. At the same time, however, we can see how dependent the advertising-funded media in particular are on the general economic development. This dynamic further erodes their competitive stance against public broadcasters as well as major global tech companies. Given this backdrop, we strongly urge lawmakers to steer clear of imposing further strains on this industry, opting instead to bolster its competitive edge.”

Claus Grewenig, Chairman of the Board at VAUNET and Chief Corporate Affairs Officer RTL Deutschland, stated: “The rich variety of commercial media can’t be taken for granted. Its existence largely hinges on a viable monetization framework. Our sector simply can’t shoulder added pressures, such as those proposed in federal government initiatives concerning advertising restrictions on certain food products or investments obligations in film funding. It’s imperative for both national government and federal states to send unambiguous signals. After all, the plurality and professional journalism of commercial media not only offer dependable guidance but also buttress our democracy – a foundation we cannot jeopardize.”

Cumulative advertising revenue in 2023

VAUNET’s forecast indicate that Germany’s audio and audiovisual advertising revenues will total €6.07 billion in 2023. This represents a 1.1 % slide from last year (2022: €6.14 billion).

Advertising revenue of radio and audio streaming in 2023

For 2023 as a whole, VAUNET foresees a 2.1 % increase in net revenue for the audio advertising sector to around €830 million (2022: €814 million). Radio advertising will see a modest 1 % growth to about €724 million. Meanwhile, advertising revenue from audio streaming platforms is set to jump by 10 %, surpassing the €100 million mark for the first time to reach €106 million (2022: €97 million).

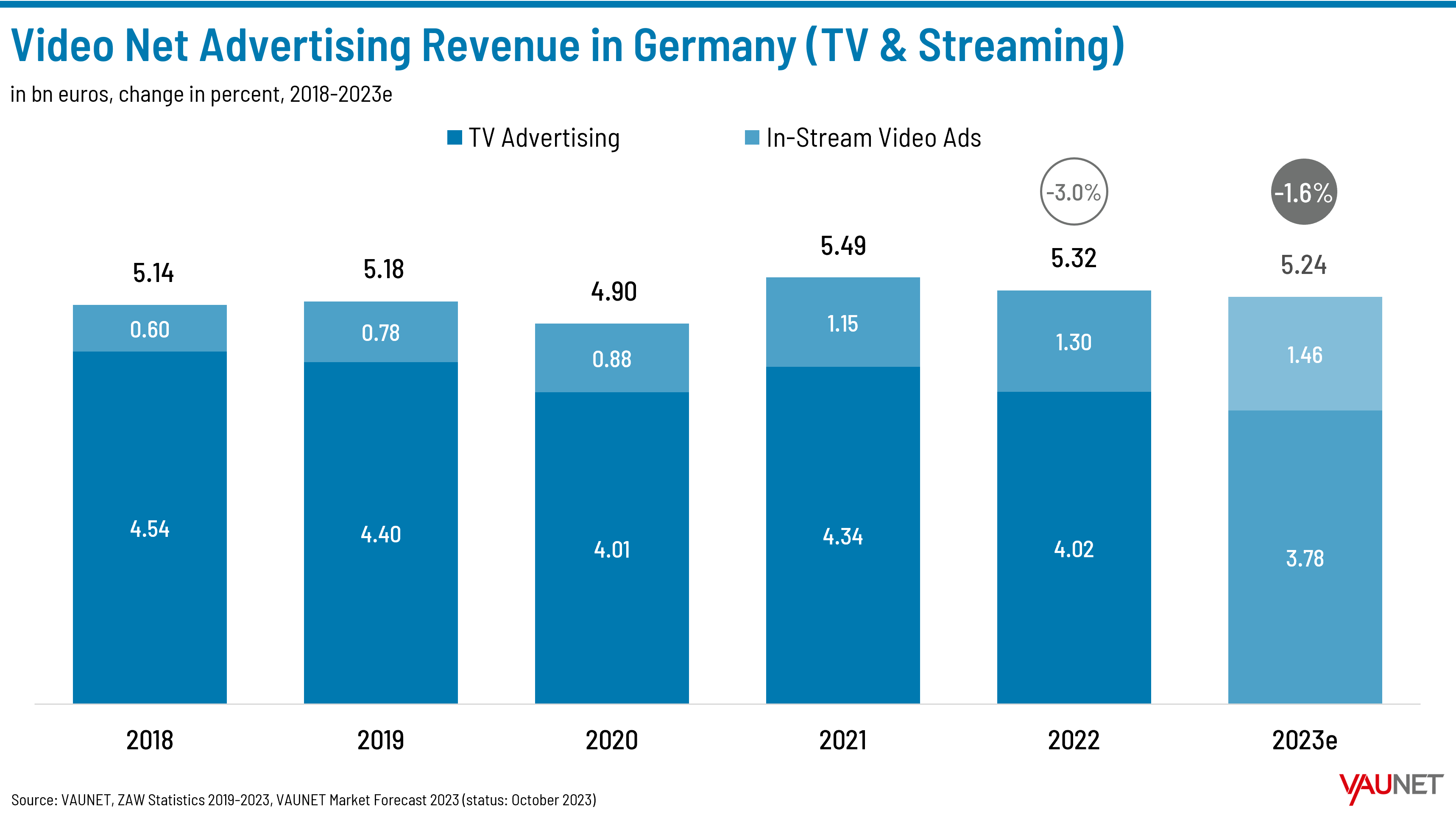

Advertising revenue for TV and video streaming in 2023

For the video advertising segment, VAUNET expects a slight overall decline in net advertising revenues in 2023 of 1.6 % to around €5.24 billion (2022: €5.32 billion). A more significant decline of 6 % to around €3.78 billion is expected for television advertising (2022: €4.02 billion). By contrast, double-digit growth of 12 % is forecast for in-stream video advertising, reaching around €1.46 billion (2022: €1.30 billion).

Revenue from paid audio and audiovisual content and teleshopping in 2023

According to VAUNET’s forecasts, revenues from paid content are set to increase by 8.0 % in 2023. Pay TV is expected to remain steady, mirroring 2022’s figure of €2.2 billion. In contrast, paid video on demand is expected to surge by 13 % to over €3.1 billion (2022: €2.8 billion). Meanwhile, revenues from paid audio are likely to rise by 10 % to over €1.8 billion (2022: €1.7 billion). For the teleshopping segment, projections hint at a stable revenue trajectory, maintaining the previous year’s figure of approximately €2.3 billion.