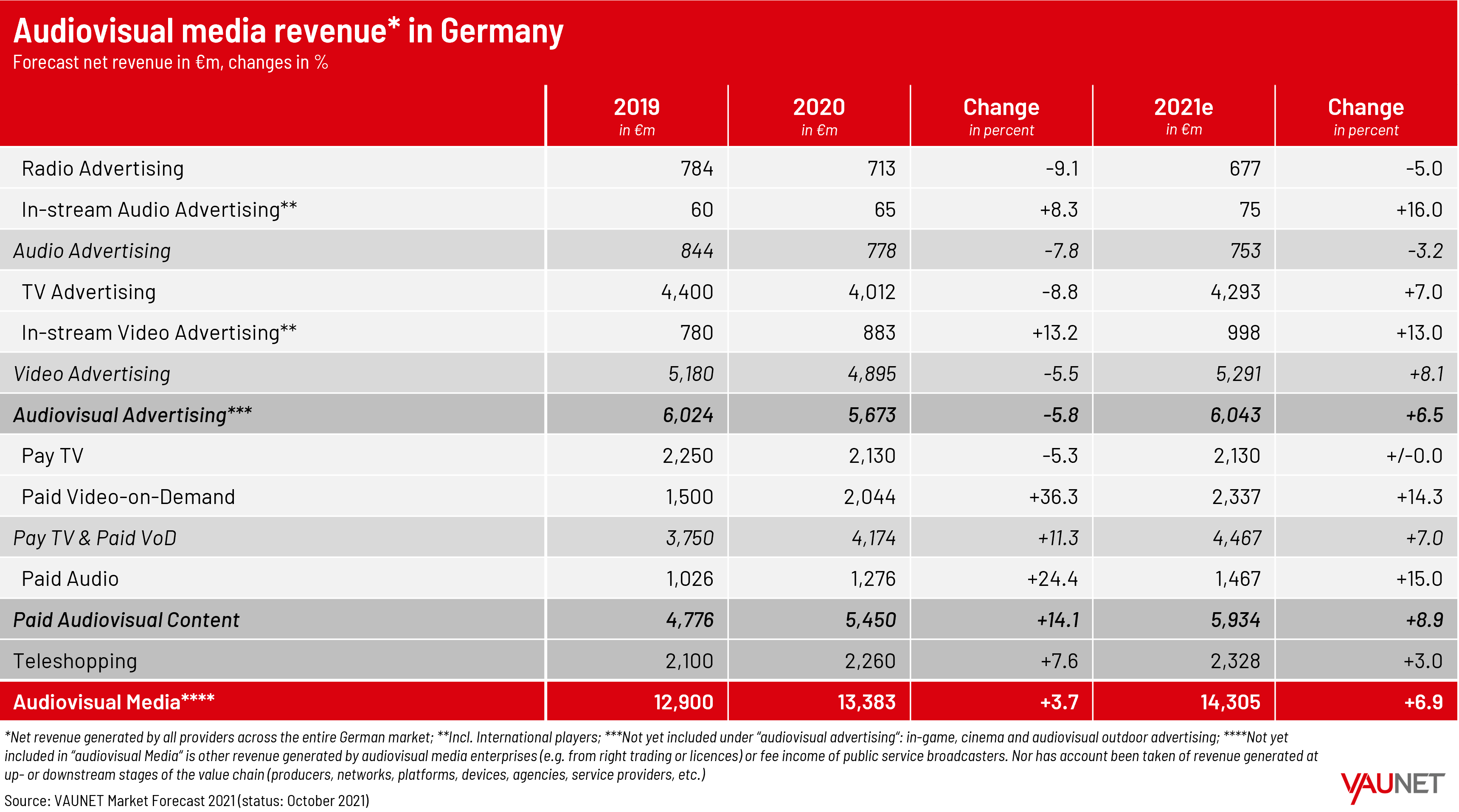

Berlin, 25 October 2021 - Revenue growth of the audio and audiovisual media in Germany in 2020 and 2021 has been impeded by the pandemic. In 2020, the turnover of all audiovisual media including streaming, paid audio and video, and teleshopping rose by 3.7 per cent to €13.38 billion. These are the key findings of the report for 2020 and the outlook for 2021 unveiled in Berlin by VAUNET, the umbrella organization for commercial audiovisual media in Germany.

By contrast, linear, advertising-funded radio services saw turnover decline significantly in 2020 by 9.1 per cent, while commercial television suffered a similar drop in revenue of 8.8 per cent. In 2021, the net revenue of the entire industry is expected to climb 6.9 per cent to a total of €14.31 billion. However, revenue from radio advertising is predicted to shrink by another 5 per cent, while television advertising revenue is set to remain below pre-crisis levels despite increasing by 7 per cent.

Frank Giersberg, one of the two Managing Directors of VAUNET: “The figures published today provide another illustration of how the audiovisual media have been impacted by the pandemic. Although the use of radio, television and streaming services increased during the crisis, above all the Covid-related reticence of advertising customers has resulted in sometimes considerable declines. Accordingly, the overall positive revenue which has been forecast for 2021 shouldn’t be allowed to hide the fact that certain segments and companies are still under considerable economic pressure as a result of the pandemic.”

Daniela Beaujean, the other Managing Director of VAUNET: “The total turnover of the audio and audiovisual industry, part of the cultural and creative industries, impressively underlines its overall economic relevance. Moreover, the cultural and creative industries – especially the media industry – have an important role to play in our democratic society. During the impending coalition negotiations, we hope that Germany’s new government will pay sufficient attention to this importance. And we also hope that, given the intensifying competition with international gatekeepers, the government will keep this importance in mind in future regulatory projects on all three political levels: regional, national and European.”

Advertising revenues of radio and audio streaming, 2020/21

In linear and non-linear audio advertising, net revenue in 2020 fell by 7.8 per cent to €778 million owing to Covid. Above all, the linear radio advertising of all commercial and public service broadcasters suffered a considerable drop in revenue year-on-year of 9.1 per cent to €713 million. In contrast, net revenues from advertising on audio streaming services continued to grow despite the crisis, rising by 8.3 per cent to €65 million. For 2021 as a whole, VAUNET forecasts that net revenues for audio advertising will decline again, dropping by 3.2 per cent to around €753 million. Radio advertising will be hit especially hard, with sales declining to €677 million after a 5.0 per cent drop in sales. This is chiefly due to the coronavirus pandemic, which continues to exacerbate conditions on regional and local advertising markets. Nevertheless, although starting from a significantly lower level, advertising on audio streaming is forecast to grow by as much as 16.0 per cent to around €75 million.

Advertising revenues of audiovisual media, 2020/21

Online video advertising was also considerably affected by the Covid crisis in 2020. Net advertising revenues fell overall by 5.5 per cent to €4.90 billion year-on-year, and by 8.8 per cent to €4.01 billion for advertising on linear TV services. Net revenues from advertising on streaming services increased by 13.2 per cent to reach €883 million. Regarding 2021, VAUNET again expects net revenue to grow in the segment of online video advertising by about 8.1 per cent to €5.29 billion. An increase of 7.0 per cent to €4.29 billion is anticipated for TV advertising, still below pre-crisis levels. As far as the instream video advertising segment is concerned, a 13.0 per cent rise to around €998 million is forecast.

Predicted cumulative advertising revenue in 2021

According to VAUNET’s forecast, audiovisual advertising revenues in Germany are set to total €6.04 billion in 2021, a rise of 6.5 per cent year-on-year. Advertising revenues from the audiovisual media sector will thus slightly exceed the pre-crisis level again with growth of 0.3 per cent (2019: €6.02 billion), largely due to the growth of non-linear streaming revenues.

Revenues from paid audiovisual content and teleshopping

Revenue for paid audiovisual content increased by 14.1 per cent to €5.45 billion in 2020. This growth was mainly driven by paid video (up 36.3% to €2.04 billion) and paid audio (+24.4% to €1.28 billion). In 2021, total paid content revenues are expected to increase by 8.9 per cent to around €5.93 billion, according to VAUNET’s forecast. Pay TV is likely to remain stable, matching the previous year’s level of €2.13 billion. Paid video-on-demand is predicted to grow by 14.3 per cent to around €2.34 billion, while revenue from audio-on-demand services is set to rise by 15.0 per cent to about €1.47 billion.

The teleshopping segment also continued to grow during the coronavirus pandemic crisis, climbing 7.6 per cent to €2.26 billion, and is expected to continue increasing throughout 2021, when VAUNET expects turnover to rise by 3.0 per cent and reach around €2.33 billion.

.

Download of the study results:

VAUNET-publication „Umsätze audiovisueller Medien in Deutschland 2020-2021“ (in German)