Berlin, 25 May 2023

- After slight declines in 2022, growth in 2023 expected to reach 1.2%

- Development in the advertising market since 2019 very volatile

- Impending advertising bans endanger media and opinion diversity

|

Berlin, 25 May 2023

VAUNET (German Media Association) expects advertising revenue in the audio and audiovisual media in Germany in 2023 to rise moderately by about 1.2 per cent to a total of €6.21 billion. This comes after a minor drop in advertising sales across audiovisual and audio advertising segments of 2.3 per cent in 2022 to €6.13 billion. However, the landscape varies across individual categories. For instance, radio advertising revenue in 2023 is expected to see an uptick of roughly 2 per cent, bringing it up to €730 million. On the other hand, television advertising is slated to witness a slump of 3.7 per cent, declining to €3.87 billion. This means that the two major segments are set to continue their trends observed in 2022, when TV advertising sales saw a 7.4 per cent dip while radio advertising sales increased by 1.5 per cent. This marked a reversal from 2021, when TV advertising rebounded after the initial year of pandemic-induced decline, and radio advertising slightly dipped. Nevertheless, both segments are expected to linger below pre-Covid levels compared to 2019. The silver lining comes from streaming providers, which have consistently shown positive growth with double-digit rates. This growth trajectory is likely to be sustained. These figures on the advertising market were released today by VAUNET in its annual spring forecast for the development of the audio and audiovisual advertising segments in Germany in 2023, which was published in connection with the annual Advertising Plenum conference hosted by the ZAW German Advertising Federation. Claus Grewenig, Chairman of the Board at VAUNET: “Advertising revenues continue to fluctuate amidst external crisis factors, presenting challenging economic impacts for media companies. In light of this volatility, it’s crucial to avoid sweeping and disproportionate disruption to our foundational financing mechanisms. The recent call from the Minister of Food and Agriculture for a blanket ban on food advertising starkly underlines the risks of political action when its repercussions for commercial media are ignored. Unfounded, wide-ranging advertising prohibitions could have dire consequences if implemented without rigorous evidence and balanced consideration of interests.” Frank Giersberg, Managing Director at VAUNET: “Advertising stands as the bedrock of media diversity in Germany. Despite a challenging market climate marked by years of crisis, audio and audiovisual media will underscore their significant value to the advertising sector in 2022 and 2023. Instream audio and video advertising continues to be a key catalyst for growth, even if it is still at a significantly lower level than traditional radio and TV advertising.”

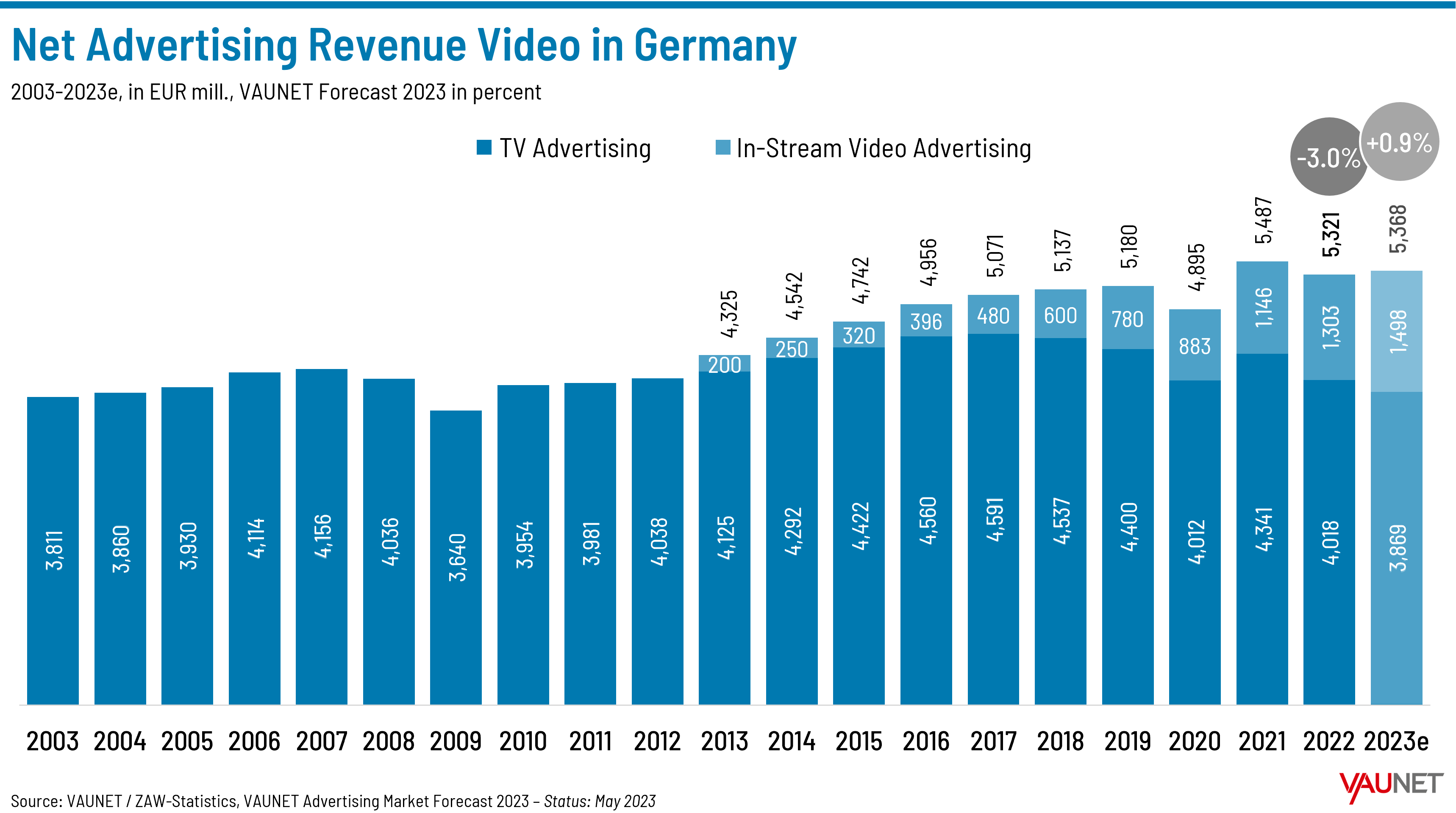

Audiovisual advertisingVAUNET’s forecast suggests that we’re set to see a rise in audiovisual advertising revenues in Germany to a total of €5.37 billion in 2023. This equates to growth of €47 million or 0.9 per cent compared to 2022. Of this, TV advertising revenues are predicted to slide by around 3.7 per cent to €3.87 billion. As a result, TV advertising revenue will remain below the pre-crisis level seen in 2019, which was €4.40 billion. Regarding net advertising revenues from audiovisual streaming, VAUNET predicts a further swell of approximately 15 per cent in 2023, reaching about €1.50 billion. In 2022, the TV advertising segment recorded a drop in advertising revenue of 7.4 per cent, dwindling down to €4.02 billion from €4.34 billion in 2021. Conversely, the video streaming advertising segment experienced a 13.7 per cent rise in revenue to €1.30 billion (2021: €1.15 billion). Consequently, overall audiovisual advertising revenues in 2022 declined by 3.0 per cent to a total of €5.32 billion, compared to €5.49 billion in 2021.

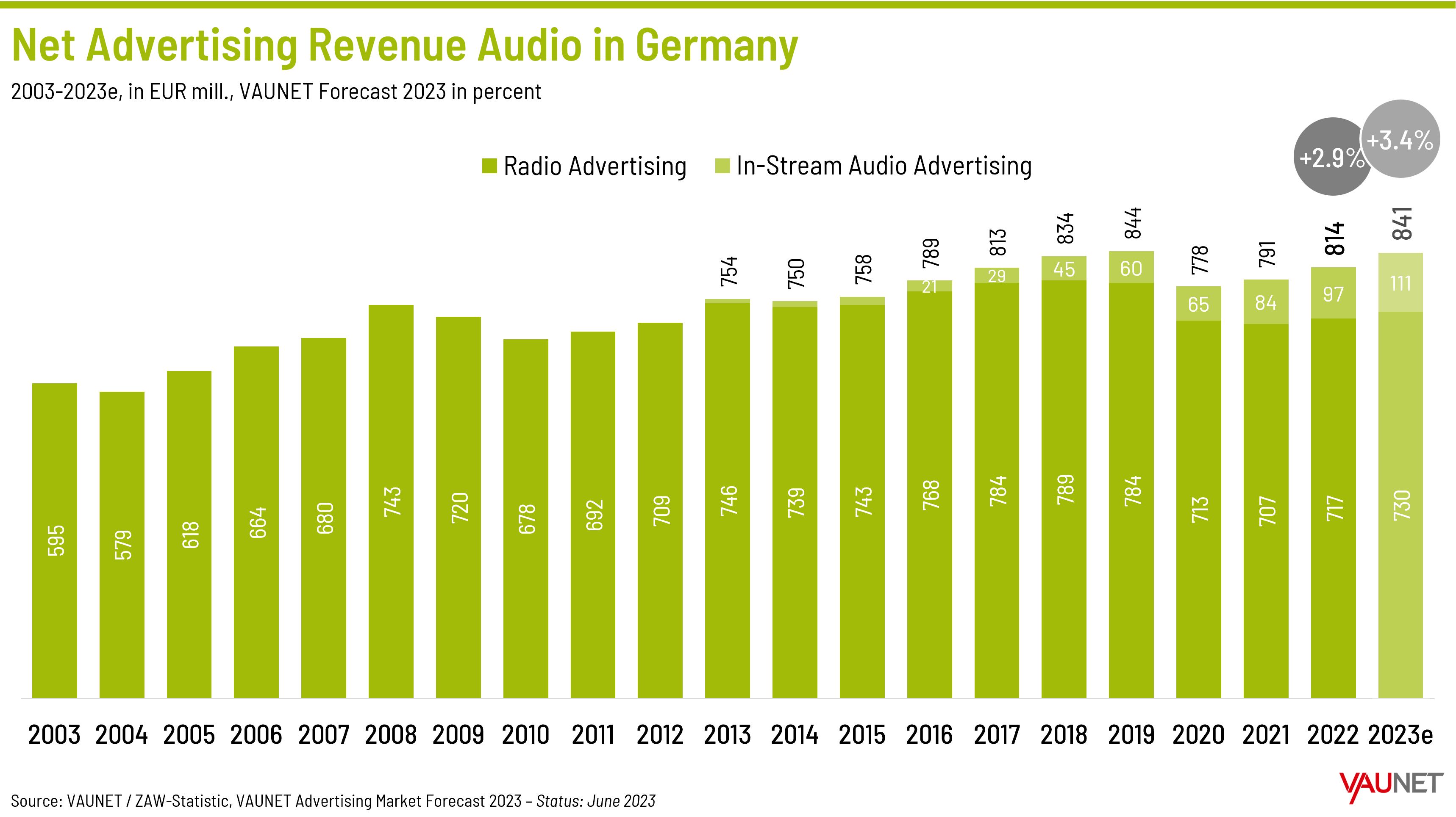

Audio advertisingAccording to VAUNET’s spring forecast, advertising revenues in audio services are expected to increase by 3.4 per cent or €28 million to €841 million in 2023. Radio advertising is also set to see a rise in sales of 2 per cent, taking it to €730 million. However, this will keep radio advertising still noticeably below its 2019 level of €784 million. As for net advertising revenues from streamed audio, VAUNET anticipates a surge of 15 per cent, rising to €111 million in 2023. In 2022, net advertising revenues in radio experienced a 1.5 per cent lift, up to €717 million from €707 million in 2021. Audio streaming advertising also saw a 15.0 per cent increase in revenue to €97 million, up from €84 million in 2021. Overall, net sales in audio advertising grew by 2.9 per cent in 2022 to €814 million, rising from €791 million in 2021.

Audio and audiovisual advertisingDespite the impressive surge in audio and video streaming in 2022, coupled with the growth in radio, overall advertising revenues in audio and audiovisual media dipped by 2.3 per cent to €6.13 billion, down from €6.28 billion in 2021. For 2023, VAUNET projects growth of 1.2 per cent to a total of around €6.21 billion. This means that audio and audiovisual advertising revenues as a whole will slightly exceed the pre-crisis level in 2019 of €6.02 billion.

Download of the VAUNET spring forecast:VAUNET spring forecast for the advertising market in 2023 (in German) About VAUNET’s spring forecast:The figures released today by VAUNET complement the official German advertising statistics from the ZAW German Advertising Federation. They are partly grounded in figures such as the annual revenue records collected by VAUNET. Other VAUNET publicationsVAUNET monitors market developments in the audio and audiovisual media in Germany with regular publications. This year, it’s already published the VAUNET Media Usage Analysis 2022. Following this spring forecast on the advertising market in 2023, it will highlight the development of the pay TV market in its Pay TV Statistics in summer, and then publish its 2023 revenue forecast for all revenue segments of the audiovisual media in autumn. |